SINGAPORE

21 August 2019

What are the hottest new start-ups to watch in Asia?

Investment in fintech across Asia looks poised to continue to grow in the years ahead. According to KPMG’s Pulse of Fintech 2018 report, investment in fintech companies in Asia hit USD 22.7B across 372 deals and was a new high in terms of fintech funding. In Singapore alone, fintech investments have nearly quadrupled to USD453M in the first half of 2019, up from USD118M last year.

Headquartered in Singapore, 4xLabs has prided itself on delivering innovations in the FX space since 2011 through our products Biz4x and Get4x. At the same time, the number of fintechs in Asia that are innovating in the FX space have continued to grow in the last couple of years, especially in areas like remittance and digital payments. With that in mind, we’ve compiled a list of 10 of these new fintechs that are making waves across Asia, some of which are household names, and others that may well become so. This is by no means a comprehensive list, but we hope to provide a snapshot of some of the interesting work being done by our Asian fintech peers that are focused on the same FX space.

Foreign Exchange

FXChange

FXChange provides currency exchange kiosks at more than 50 hotels and tourist hotspots in Singapore. Currently the kiosks accept foreign currencies for conversion to Singapore dollars and vice versa. You can also purchase attraction tickets, F&B vouchers and book transportation through the kiosks.

Headquarters: Singapore

https://fxchange.sg/

ReadyTravel

ReadyTravel, a Hong Kong Science and Technology Parks Corporation (HKSTP) incubatee has introduced its first physical kiosk for P2P FX deposit and withdrawal known as ReadyKiosk. It matches users looking to exchange currencies and facilitates this exchange whether cash-to-cash, cash-to-digital or digital-cash. Physical redemption of currencies can be done at the kiosk which will be installed in all major ports of entry and exit.

Headquarters: Hong Kong

Source

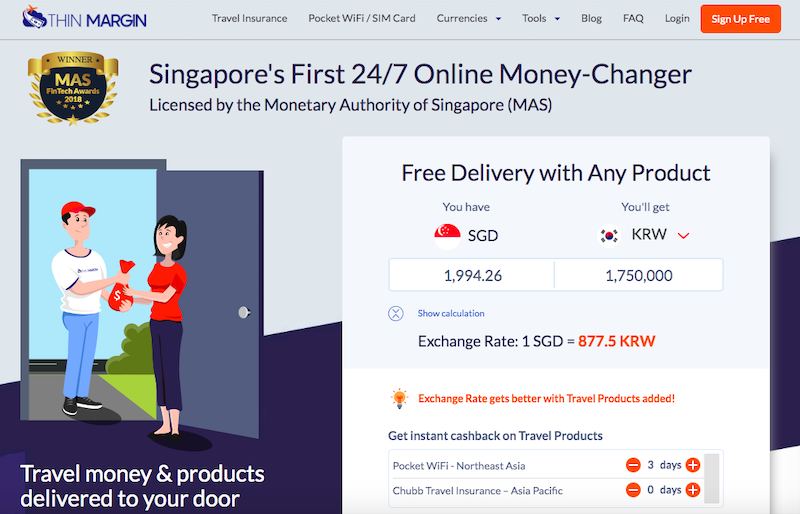

Thin Margin

Thin Margin is an online money changer that not only provides foreign exchange services 24/7 but conveniently delivers any booked currencies directly to your doorstep. They accept digital payments and sell bundled travel products like insurance. The platform has promotional rates for certain currencies that are even better than the mid-market rate and list their live rates on Get4x.

Headquarters: Singapore

https://www.thinmargin.com/

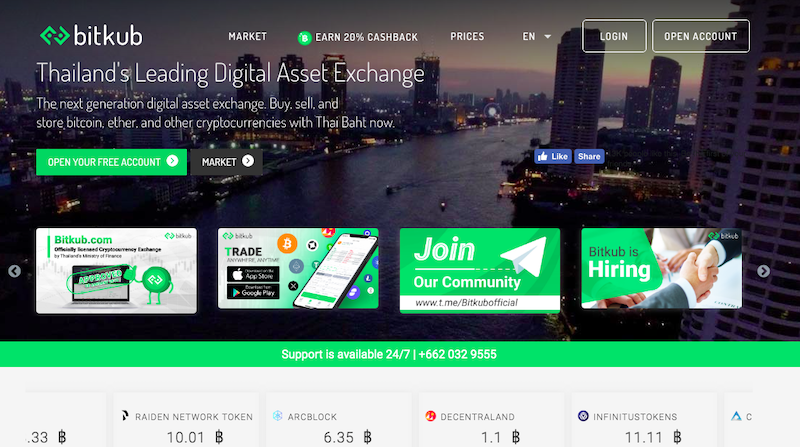

Bitkub

Bitkub is a digital asset and cryptocurrency blockchain exchange platform that is licensed by the Thai Ministry of Finance. It means to facilitate the exchange of Thai baht to cryptocurrency and vice versa, and also offers a multi-cryptocurrency wallet.

Funding: $2.1M

Headquarters: Thailand

Investors: dtac Accelerate, SeaX Ventures

https://www.bitkub.com/

Remittance

KOKU

KOKU has raised $500K in funding from a Tencent founder, Jason Zeng via Decent Capital. The firm acts as an intermediary between remittance companies, private equity firms and non-bank financial institutions matching them to broker FX transfer deals.

Funding: $2M

Headquarters: Singapore

Investor: Decent Capital

https://www.koku.io/

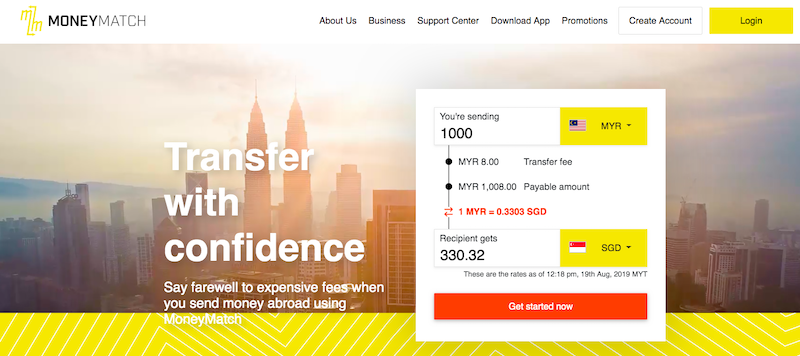

MoneyMatch

MoneyMatch enables digital cross-border international payments and remittances that are cheaper and faster than traditional banks. MoneyMatch was part of Bank Negara Malaysia’s regulatory sandbox and were among the first to be approved by BNM’s Financial Technology Enabler Group to provide eKYC onboarding.

Funding: $612.5K

Headquarters: Malaysia

Investors: Cradle Seed Ventures, Tuas Capital Partners, TH Capital, WatchTower & Friends, Kosciuszko Holdings

https://transfer.moneymatch.co/

Mobile Wallets

DANA

DANA is an eWallet that allows cashless transactions such as mobile top-ups, utility bill payments. It allows users to send and receive money via mobile, pay through QR codes and make transactions with a DANA account or debit card.

Headquarters: Indonesia

Investor: Ant Financial

https://dana.id/

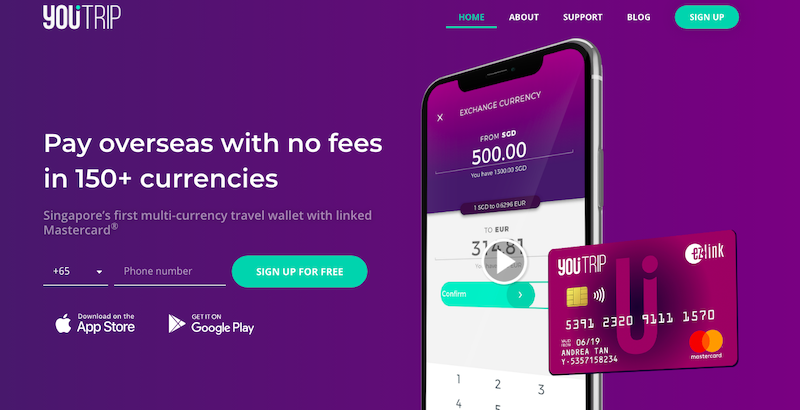

YouTrip

YouTrip provides a mobile wallet that allows users to pay in more than 150 currencies at wholesale exchange rates. The mobile wallet allows the exchange and storage of 10 currencies and can be paired with a pre-paid Mastercard issued by EZ-Link.

Funding: $25.5M

Headquarters: Singapore, Hong Kong

Investor: Insignia Ventures Partner

https://www.you.co/en-SG/

Pearl Pay

Pearl Pay is building an ecosystem and unified payment network. They provide a white-labelled mobile eWallet, that is linked to a prepaid Mastercard. The company has both a core and agent banking solution.

Headquarters: Philippines

https://www.pearlpay.com/en/

Pi Pay

Pi Pay is a mobile payment platform that is widely used and accepted by thousands of merchants in Cambodia. Aside from retail purchases, users can also transfer money, pay utility bills and book event tickets through the app. Pi Pay has partnered with local financial institutions as well as China’s Alipay and WeChat Pay.

Headquarters: Cambodia

https://www.pipay.com/

Have an opinion on our list of innovators? Share your thoughts on which new fintech startup should be in the list above. We’ve shortlisted the above fintechs as they have recently launched products in the last couple of years in the realm of FX and are representative of the fintech developments across the region.

Speaking of which, 4xLabs has also recently launched a new product in the last couple of months... If you’ve yet to hear of Send4x, why not give it a whirl? It’s a platform for comparing remittance rates, especially in Asia, in our constant quest to improve the money services industry through digitalisation and transparency!

About 4xLabs

4xLabs is a Singapore fintech that develops technology solutions for financial and professional services. In 2012, the company launched an online app for comparing money changing rates known as Get4x, which has a growing community of 260,000 users, and is available in 22 cities. In 2016, it launched an online integrated platform for money services business to manage all aspects of their business, known as Biz4x. Biz4x is used in more than 35 countries today. The latest innovation from 4xLabs is Send4x, a platform that compares and breaks down the cost of remittance.